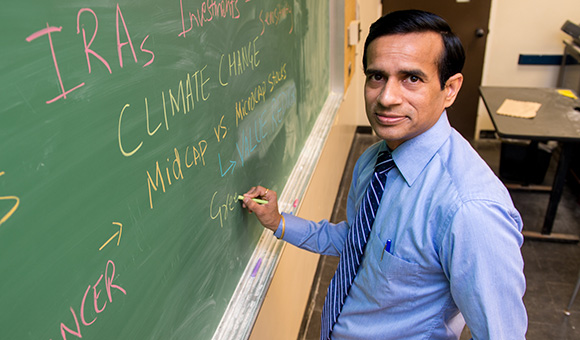

Umesh Kumar, Ph.D.

Professor of Finance

School of Business and Liberal Arts

Finance, B.B.A

Office: MacArthur 430A

Phone: 315-386-7974

Email: kumaru@canton.edu

Educational Background

- B.S., Magadh University, India

- MBA, University of Mumbai, India - Finance

- Ph.D., University of Texas at San Antonio - Finance

Professional Experience

-

Over six years of managerial experience with the Securities & Exchange Board of India

Research Interest

- Empirical Corporate Finance

- Investment Pricing Anomalies

- Cryptocurrencies

- Fintech and Decentralized Finance

- Sustainable Enterprise

- Climate Change

Courses Taught at SUNY Canton

- BSAD 100 - Introduction to Business

- ECON 305 – Economics of Crime

- FSMA 210 - Introduction to Finance

- BSAD 241 – Investment and Trading

- FSMA 312 – Financial Management

- FSMA 320 – Invest. Analysis and Portfolio Mgmt.

- FSMA 325 – Financial Compliance & Reg.

- FSMA 415 - Global Finance

- FSMA 422 - Risk Management

- ECON 101 - Principles of Macroeconomics

- ECON 314 - Managerial Economics

- FSMA 220 - Introduction to Investments

- FSMA 301 – Personal Finance

- FSMA 315 – Global Investments

- FSMA 330 - Financial Markets and Inst.

- FSMA 391- Real Estate Finance and Invest

- FSMA 420 - Financial Derivatives

Publications

- The Consequence of COVID-19 on Cryptocurrency Returns, Journal of Finance Issue, (with Biqing Huang), Accepted for Publication.

- Retail Investor Sentiment and Indian ADR Premiums, Academy of Business Journal, Volume I, 2023.

- Do Value and Growth Matter in Wide-Moat Firms? Journal of Finance and Accountancy, Volume 32, September 2023.

- Do Small Trades influence the Indian ADR Premiums? Journal of Academy of Business and Economics, Volume 23, Issue 1, 85-96, March 2023.

- COVID-19 and Investor Response – The case of the Oil and Gas Industry, Journal of Finance and Accountancy, (with Biqing Huang), Volume 32, 2023.

- Are Indian ADR Premiums Mispriced? International Journal of Finance, Volume 8, Issue No. 1, Page 1-18, 2023.

- Macroeconomic Signals and Indian Real Estate Firms, International Journal of Economic Policy, Volume 3, Issue 1, Page 1-16, 2023.

- The Impact of R&D Investment and High Technology Goods Exports Between the U.S. and China, Journal of International Finance and Economics, Volume 22, Issue 3, Page 28-37, 2022.

- Tax Reforms, Investor Sentiment, and Closed-End Fund Performance, International Journal of Finance, Volume 7, Issue No. 4, Page 71-86, 2022.

- Does Money Talk? Examining from Currency Exchange Rates and International Trade, Journal of International Finance and Economics, (with Biqing Huang and Bandon Painter), Volume 22, Issue 2, Page 35-46, 2022.

- Electrical Power Grid Disruptions: A Time Series Examination, Journal of Critical Infrastructure Policy, (with Brian Harte)), Page 197-216, Winter/Fall 2020.

- Convicted Firms, Board Composition, and Corporate Social Responsibility in the Post Sarbanes-Oxley Act Era, Academy of Business Research Journal (with Brian Harte), Volume III 2019.

- Market Based Incentives in Developing Countries: Geographical Dispersion, Antecedents and Implications of the Clean Development Mechanism, Climate and Development (with John Fay), Pages 164-177, Volume 9, Issue 2, 2017.

- An Index-Based Model for Determining the Investment Benchmark of Renewable Energy Projects in South Africa, South African Journal of Economics (with John Fay), Volume 33, Issue 3, September 2013

- Impact of Liquidity on the Futures–Cash Basis: Evidence from the Indian Market (with Palani-Rajan Kadapakkam), Journal of Futures Markets, Volume 33, Issue 3, March 2013

- Corporate Social Responsibility and Investor Response in the Post-SOX Era (with Brian Harte), Journal of Applied Financial Research, Vol 1 2012

- Settlement Differences and the Law of One Price: Evidence from the Indian Stock Market (with Palani-Rajan Kadapakkam), Journal of Emerging Markets, Vol. 14, Issue 2, 2009

- Single-Stock Futures: Evidence from the Indian Securities Market (with Yiuman Tse), Global Finance Journal, Volume 20, Issue 3, 2009

Other Publications

- “The Contours of Risks in Venture Capital”, SEBI Bulletin, December 2004, 24–34

- “The Implications of STP in Capital Market”, SEBI Bulletin, October 2004, 12–20

- “Corporate Governance: A Calibration of Risk Management”, SEBI Bulletin, August 2004, 5–12

Book Chapters

- ‘Are Indian ADR Premiums Mispriced?’ research work has been published as a book chapter in a Book titled “Operating Factors in Financial Performance”

- ‘Tax Reforms, Investor Sentiment and Closed-End Fund Performance’ research work has been published as a book chapter in a Book titled “Fundamentals of Financial Performance”